Excitement About Offshore Banking

Table of ContentsThe Basic Principles Of Offshore Banking Not known Details About Offshore Banking The smart Trick of Offshore Banking That Nobody is DiscussingOffshore Banking for BeginnersOffshore Banking Can Be Fun For AnyoneSome Known Incorrect Statements About Offshore Banking The smart Trick of Offshore Banking That Nobody is DiscussingThe Best Guide To Offshore BankingThe Ultimate Guide To Offshore Banking

This procedure assists produce liquidity in the marketwhich creates cash and also maintains the supply going. Similar to any type of various other business, the goal of a financial institution is to earn a revenue for its proprietors. For most banks, the proprietors are their shareholders. Banks do this by charging even more interest on the car loans and also other financial obligation they issue to customers than what they pay to individuals that use their savings automobiles.

The Ultimate Guide To Offshore Banking

Financial institutions earn a profit by billing even more passion to borrowers than they pay on savings accounts. A financial institution's size is identified by where it lies and also who it servesfrom tiny, community-based establishments to big industrial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured commercial banks in the United States as of 2021.

Conventional banks supply both a brick-and-mortar place and also an on-line existence, a new fad in online-only banks emerged in the early 2010s. These financial institutions often supply consumers greater rate of interest rates and lower costs. Benefit, rate of interest, and also charges are some of the elements that assist customers decide their favored financial institutions.

Offshore Banking for Beginners

You need to think about whether you want to maintain both company and also individual accounts at the same bank, or whether you want them at separate financial institutions. A retail financial institution, which has fundamental banking services for customers, is the most proper for everyday banking. You can select a typical financial institution, which has a physical structure, or an on-line bank if you do not desire or need to literally check out a financial institution branch.

A community financial institution, for example, takes down payments and lends locally, which can supply a much more customized banking partnership. Pick a hassle-free location if you are selecting a financial institution with a brick-and-mortar location. If you have a financial emergency situation, you do not wish to need to travel a lengthy distance to get cash money.

What Does Offshore Banking Mean?

Some banks also use smart device applications, which can be helpful. Some huge banks are moving to finish overdraft account charges in 2022, so that could be a crucial consideration.

After making some marginal reductions (in try this website the form of commission), the financial institution pays the costs's worth to the holder. When the bill of exchange grows, the bank obtains its repayment from the event, which had accepted the expense. Banks provide cheque pads to the account owners. Account-holders can attract cheques upon the financial institution to pay cash.

Offshore Banking Fundamentals Explained

Financial institutions help their More Info clients in moving funds from one area to an additional via cheques, drafts, and so on. A credit card is a card that enables its owners to make purchases of items and also solutions in exchange for the bank card's provider quickly paying for the items or service. The cardholder debenture back the acquisition quantity to the card supplier over a long time and with interest.

Mobile financial (additionally called M-Banking) is a term made use of for executing balance checks, account deals, payments, credit report applications, and also other financial transactions through a mobile gadget such as a mobile phone or Personal Digital Aide (PDA), Accepting down payments from savers or account owners is the main feature of a financial institution.

Things about Offshore Banking

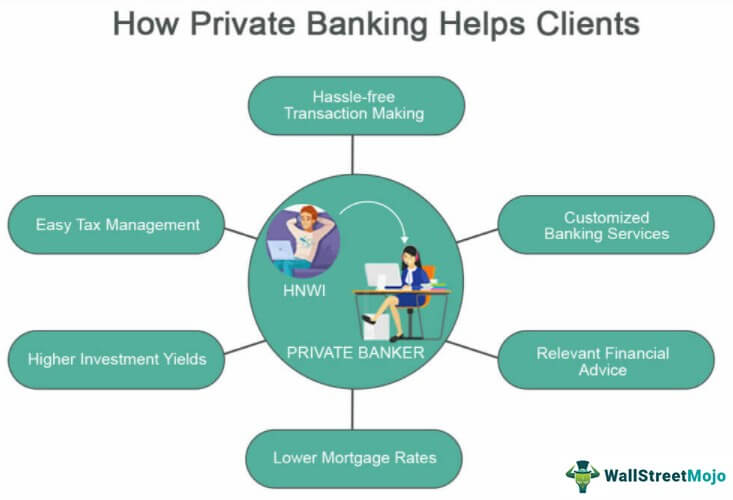

Individuals like to deposit their financial savings in a bank since by doing so, they make rate of interest. Concern financial can consist of several different solutions, however some preferred ones include complimentary monitoring, online bill pay, financial consultation, as well as details. Customized economic and banking services are typically supplied to a financial institution's electronic, high-net-worth people (HNWIs).

Personal Banks intend to match such people with the most proper options. offshore banking.

The smart Trick of Offshore Banking That Nobody is Talking About

Not only are cash market accounts Federal Down payment Insurance Corporation-insured, but they gain greater passion rates than inspecting accounts. Cash market accounts decrease the danger of spending since you constantly have accessibility to your cash you can withdraw it at any moment without penalty, though there might some constraints on the variety of purchases you can make monthly - offshore banking.

Company banking usually offers higher profits for banks due to the huge amounts of cash and passion entailed with corporate car loans. Often the two divisions overlap in regards to their solutions, yet the genuine difference remains in the clientele as well as the profits each banking type gains. A company banker jobs very closely with customers to establish which financial products and services best fit their requirements, such as organization bank account, charge card, treasury administration, car loans, also repayment processing.

Get This Report on Offshore Banking

You intend to select a financial institution that uses a complete variety of solutions so it supports your banking needs as your organization expands. Below are several of the features to look for. ACH allows cash to be moved electronically without making use of paper checks, wire transfers or cash money. It can be click made use of for both payables and also receivables.