The 6-Minute Rule for Offshore Banking

While many domestic accounts restrict your capability in holding various other money denominations, accounts in Hong Kong or Singapore, for instance, allow you to have upwards of a lots currencies to chose from all in just one account. 8. International Accounts Provides You Greater Asset Protection, It pays to have well-protected funds.

With no accessibility to your properties, exactly how can you protect yourself in court? Cash as well as properties that are kept offshore are much harder to confiscate due to the fact that foreign governments do not have any kind of territory and also consequently can not require financial institutions to do anything. Regional courts as well as federal governments that manage them just have limited impact (offshore banking).

, that is not also unusual. If you are struck with a claim you can be basically reduced off from all your properties prior to being brought to trial.

Be certain to check your nations arrangements and also if they are a signatory for the Common Reporting Plan (CRS). Nonetheless, with an offshore LLC, Limited Firm or Trust fund can offer a step of privacy that can not be located in any type of personal residential account. Financial institutions do have a rate of interest in maintaining confidential the names as well as information of their clients as in places like Panama where privacy is militantly preserved, nevertheless, Know Your Consumer (KYC) rules, the CRS as well as the OECD have significantly reshaped banking privacy (offshore banking).

Unknown Facts About Offshore Banking

Utilizing nominee directors can likewise be used to create one more layer of safety that removes your name from the paperwork. Though this still does not make you entirely anonymous it can offer layers of safety and security and personal privacy that would certainly or else not be feasible. Takeaway, It is never ever far too late to develop a Fallback.

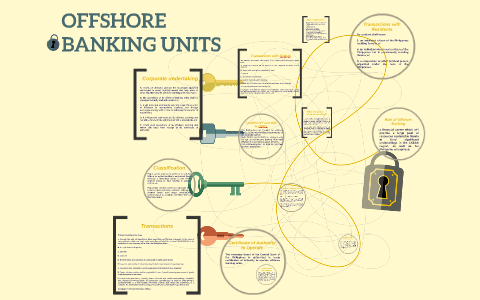

What Is Offshore? The term offshore refers to a location outside of one's house country., investments, as well as down payments.

Increased stress is causing more coverage of international accounts to international tax authorities. Understanding Offshore Offshore can refer to a variety of foreign-based entities, accounts, or other financial solutions. In order to qualify as offshore, the activity occurring needs to be based in a nation apart from the business or investor's house nation.

Offshoring isn't normally illegal. Hiding it is. Special Considerations Offshoring is completely legal due to the fact that it provides entities with a lot of privacy as well as discretion. Authorities are worried that OFCs are being used to prevent paying tax obligations. Thus, there is boosted stress on these nations to report foreign holdings to global tax authorities.

Offshore Banking Fundamentals Explained

Sorts of Offshoring There are several sorts of offshoring: Business, investing, as well as banking. We have actually gone into some information regarding how these job below. Offshoring Organization Offshoring is frequently described as outsourcing when it involves organization task. This is the act of developing specific service functions, such as production or call facilities, in a nation apart from where the firm is headquartered.

Firms with substantial sales overseas, such as Apple and also Microsoft, might take the opportunity to keep relevant profits in offshore accounts in nations with lower tax obligation concerns. Offshore Investing Offshore spending can include any scenario in which the overseas investors stay outside the nation in which they spend. This method is mostly utilized by high-net-worth financiers, as running offshore accounts can be especially high.

Offshore investors may additionally be looked at by regulatory authorities and also tax obligation authorities to make sure taxes are paid.

Offshore territories, such as the Bahamas, Bermuda, Cayman Islands, and also the Island of Male, are popular and also understood to supply rather secure financial investment opportunities. Benefits as well as Negative Aspects of Offshore Investing While we've noted some usually accepted advantages and disadvantages of going offshore, this area considers the benefits as well as drawbacks of offshore investing.

See This Report on Offshore Banking

This implies you might be on the hook if you don't report your holdings. Make sure you pick a trusted broker or financial investment professional to ensure that your money is managed properly.

What Is Onshore as well as Offshore? Onshore suggests that company task, whether that's running a company or holding possessions and investments, occurs in your home country. Going offshore, on the various other hand, suggests these tasks take place in an additional nation, area, or territory. Are Offshore Accounts Legal? Offshore accounts are flawlessly lawful, as long as they are not made use of for immoral objectives. offshore banking.

These accounts are normally opened up for a holding business instead of an individual. Trading this means provides investors with favorable tax obligation treatment, which places more refund right into their pockets. The Base Line Going offshore is typically an option meant only for firms or people with a high web well worth.

Please confirm that you are human.

Offshore Banking for Dummies

Offshore banking describes keeping your cash in an account situated outside of your own nation of residence, normally at a financial institution in another nation. The concept behind offshore financial is that the passion you make accurate you transfer in this account can be tax-free, because many governments will certainly not enforce taxes on money made overseas by their people as well as businesses.

check visit our website find more information